Applying for a loan is one of the biggest financial decisions you’ll make. Whether it’s a personal loan, home loan, car loan, or business loan, understanding the process helps you avoid rejection, save on interest, and make informed choices. Here’s a complete guide to help you prepare before applying for a loan in India.

1. Know Your Loan Type

Different loans serve different needs:

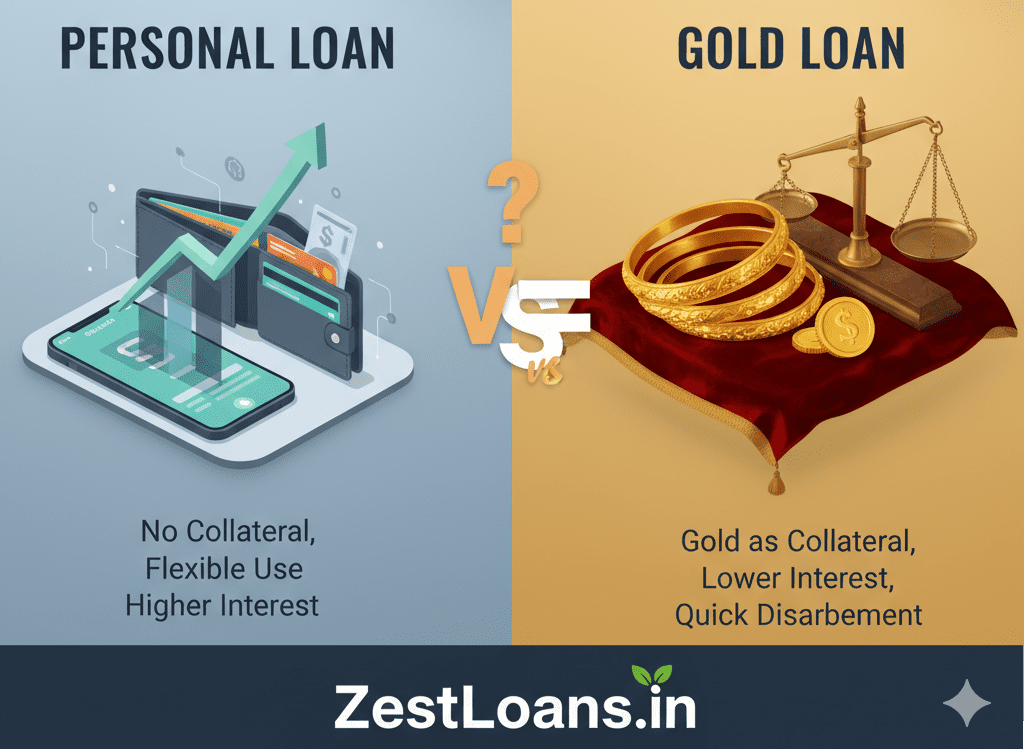

- Personal Loan: For medical expenses, travel, or debt consolidation.

- Home Loan: For buying or constructing a house.

- Car/Vehicle Loan: For purchasing a new or used vehicle.

- Education Loan: For funding higher studies in India or abroad.

- Business Loan: For expanding or managing a business.

Choose the loan that fits your purpose to get better terms and faster approval.

2. Check Your Credit (CIBIL) Score

Your CIBIL score reflects your creditworthiness.

- A score above 750 is considered excellent.

- A low score can result in higher interest rates or rejection.

Check your score for free online before applying and clear pending dues to improve it.

3. Compare Interest Rates

Interest rates vary between banks and NBFCs.

- Fixed Rate: Remains constant throughout the loan tenure.

- Floating Rate: Changes as per market conditions.

Use online loan comparison tools to find the lowest EMI and best lender.

4. Understand Loan Eligibility

Lenders evaluate:

- Your income and employment type

- Age and repayment capacity

- Existing debts and credit utilization

Use an eligibility calculator to estimate how much loan you can get before applying.

5. Prepare Required Documents

Keep these ready to speed up approval:

- ID Proof: PAN Card, Aadhaar Card

- Address Proof: Utility bills, passport, or voter ID

- Income Proof: Salary slips, ITR, or bank statements

- Property Documents: For secured loans

6. Calculate EMI and Tenure

Use an online EMI calculator to plan your monthly repayments.

A longer tenure reduces EMI but increases total interest paid.

Choose a balance that suits your income and budget.

7. Check for Hidden Charges

Apart from interest, watch out for:

- Processing fees

- Prepayment penalties

- Late payment charges

Read the fine print carefully before signing the loan agreement.

8. Apply with the Right Lender

Select a lender known for:

- Transparent terms

- Quick processing

- Good customer support

You can apply through bank DSAs like ZestLoans.in, which help you compare and apply to multiple banks at once.

9. Maintain Stable Income and Job

Lenders prefer applicants with a stable job or business income for consistent repayments. Avoid job changes during the loan process.

10. Keep a Co-Applicant or Guarantor (if needed)

If your income or CIBIL score is low, adding a co-applicant can improve your approval chances and help you secure better rates.

Final Thoughts

Before applying for any loan in India, take time to assess your needs, credit score, and repayment capacity. An informed borrower always saves more in the long run.